Qbi deduction calculator

When to file Form 1040. From there you.

Using A Qualified Retirement Plan To Take Advantage Of Tcja Provisions The Cpa Journal

Your salary would not be deductible on schedule C nor reportable as wages on the 1040.

. Unfortunately it has no effect on your self-employment taxes only your income taxes. Which can impact your companys qualified business income deduction QBI. Turns out you can qualify for the QBI deduction as long as your rental activities constitute a trade or business.

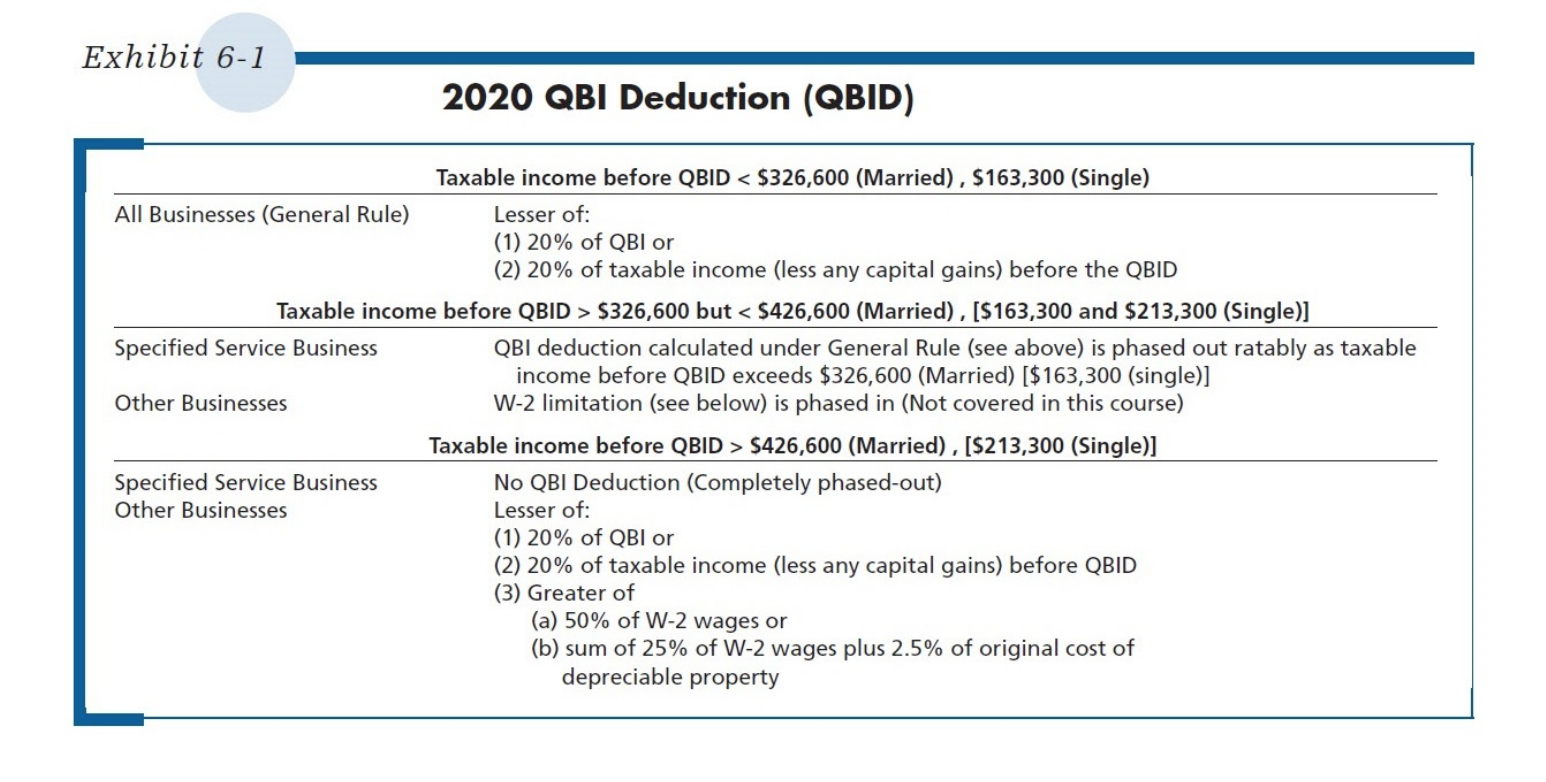

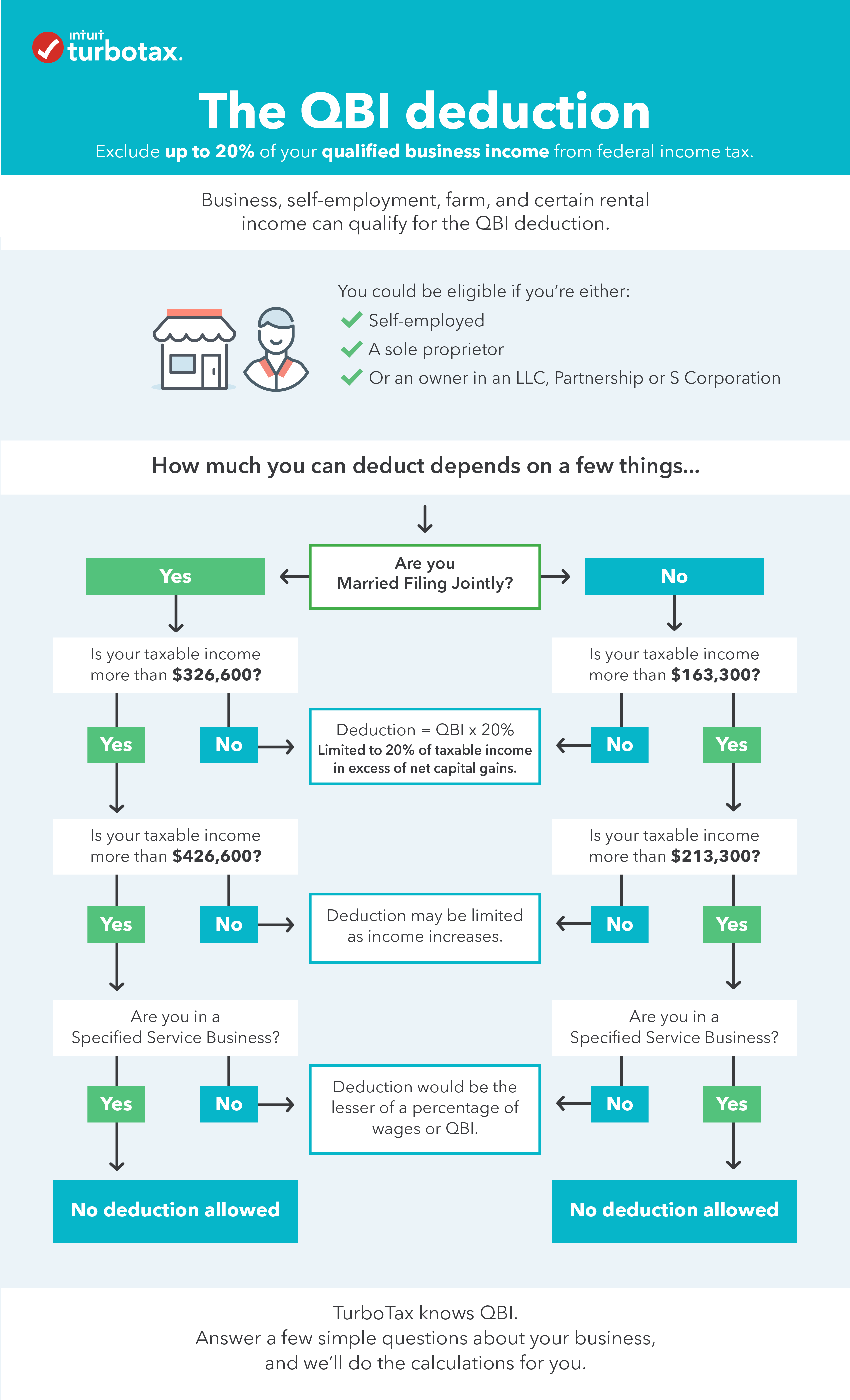

Unlike the standard deduction there are limitations for the QBI deduction. What It Is Who Qualifies. The 2000 lowers your overall taxable income just like the standard deduction does.

Credit Card Interest Calculator. Tax season 2022 is between early 2022 and April 18 2022. Best Tax Software for 2022.

The following is a list of items that are not subtracted from your income. However only certain types on income listed on Schedule K-1 will qualify for QBID. Line 14 asks you to add up line 12 and 13 for the total value of your deductions from the previous three lines.

A sole proprietor can not pay himself a salary so did you really file a W-2 and 941s. Adjusted Gross Income AGI is your net income minus above the line deductions. A popular deduction in recent years is the qualified business income or QBI which can reduce business owners taxable income up to 20.

You may also qualify if you had income from REIT dividends or from a publicly traded partnership PTP. The qualified business income QBI deduction under Sec. Congress traditionally passed an annual patch to address this until in January 2013 they passed a permanent patch.

You first determine your self-employment or business income and report your adjusted gross income on Form 1040. The LLC tax rate calculator is used by corporations to calculate their taxes. 1 QBI earned from a sole proprietorship or a single-member LLC SMLLC thats treated.

Through 2025 the qualified business income QBI deduction for self-employed folks can be up to 20 of. The qualified business income deduction also called the QBI deduction lets you deduct up to 20 of that income. This deduction is not available for personal service.

The deduction allows an individual to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. See the following articles for information on the QBI calculation. There are many issues besides the QBI deduction.

Generally this means each rental real estate enterprise a rental property or group of similar rental properties including K-1 rental income must satisfy these. Another advantage of S corporation status is that an S corp owner can take a 20 tax deduction from their share of business income in addition to usual deductions for business expenses. You dont need to itemize to claim the QBI deduction but you will need to fill out Form 8995 or Form 8995-A.

But because it was not automatically updated for inflation more middle-class taxpayers were getting hit with the AMT each year. Line 13X - Section 965c deduction - Amounts reported in Box 12 Code K represent a taxpayers share of section 965a deductions. This Qualified Business Income QBI deduction is calculated on the owners income as an employee.

Use our W-4 calculator and see how to fill out a 2022 Form W-4 to change withholdings. The calculator took one of these for you known as the self employment deduction. Standard deduction 12400 for single filers in 2020 and Section 199A sometimes referred to as QBI.

What if you own a rental or three but dont qualify as a real estate professional. You will need to attach either Form 8995 or Form 8995-A to take the QBI deduction. Tax year 2021 sees the limits rise to 164900 and 329800 respectively.

Pay withholding medicare and fica taxes. Qualified Business Income Deduction QBI. Section 199A Qualified Business Income Deduction 1041 For 1041 returns not prepared in UltraTax CS enter the amount reported on Schedule K-1 Box 13 in the Section 1099A income field on the K1T-3 screen.

Our calculator accounts for these but its not able to handle all scenarios. Any amount reported as a deduction would reduce any 965 a inclusion amount reported in Box 10 Code F. 1 the allocable deduction for a contribution to a self-employed retirement plan 2 the allocable deduction for 50 of your self.

20 QBI Deduction Calculator is an easy to compute calculator for the deduction that started after the amended Internal Revenue Code courtesy Tax Cuts Jobs Act came into force. This is a guide on entering the Deduction items from Schedule K-1 Form 1065 into the tax program. Taxes are determined based on the company structure.

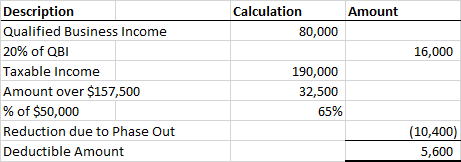

If so you have a mess on your hands. So from the tax year 2018 sole proprietors partnership firms S corporations and some trusts and estates are eligible for a qualified business income QBI. In general to claim the QBI deduction your taxable income must fall below 163300 for single filers or 326600 for joint filers in 2020.

Seek professional help to fix this. The Alternative Minimum Tax AMT was designed to keep wealthy taxpayers from using loopholes to avoid paying taxes. Wheres my QBI Deduction.

According to the IRS QBI from a business is reduced by.

1040 Tax Planner Qualified Business Income Deduction Drake17

20 Qbi Deduction Calculator For 2021

2

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

How To Calculate The 20 199a Qbi Deduction Very Detailed 20 Business Tax Deduction Explained Youtube

20 Qbi Deduction Calculator For 2021

Overview Of The Qualified Business Income Qbi Deduction

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Solved Calculation Of Qualified Business Income Deduction Chegg Com

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Calculation Of The 20 Deduction For 2018 Pass Through Entities Steemit

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Qualified Business Income Deduction Facts And Tips 2022 Lawrina

Qbi Calculator Wilson Rogers Company

Do I Qualify For The Qualified Business Income Deduction